Ohio Motor Fuel Tax Rates

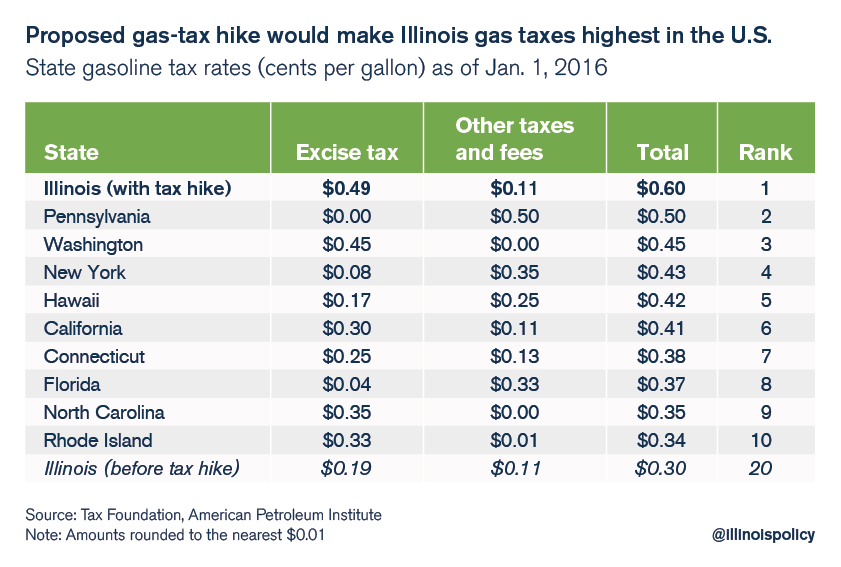

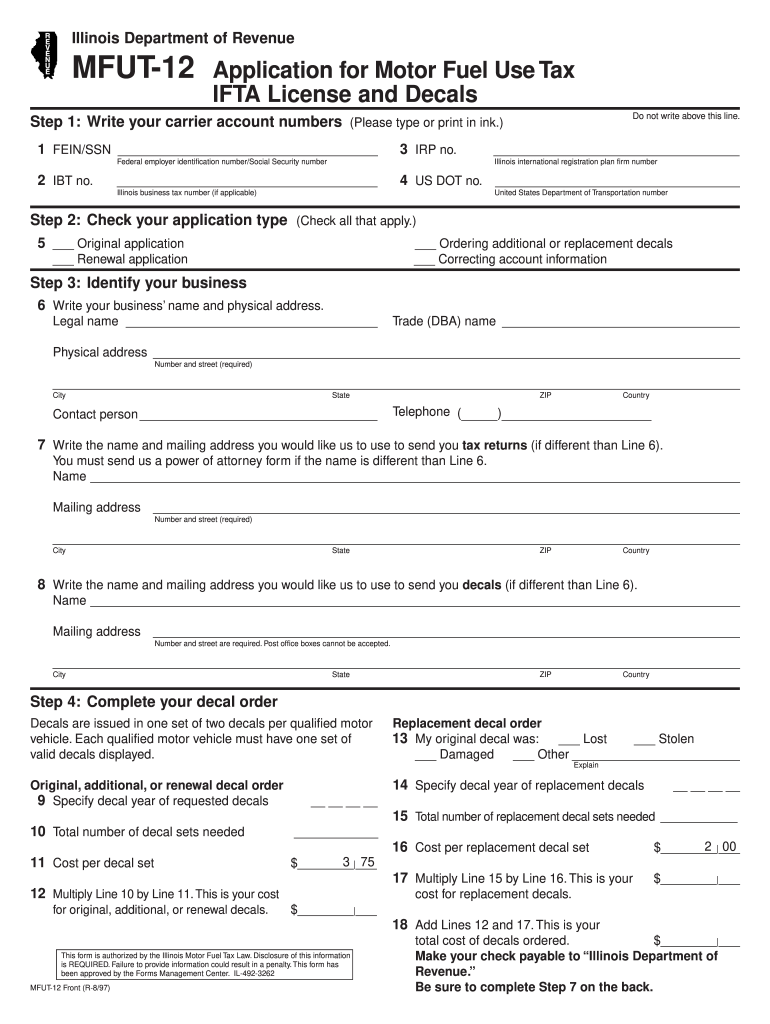

Ohio Motor Fuel Tax Rates. Il, 5 cents in chicago and 6 cents in cook county (gasoline only); (a) motor vehicles includes all vehicles, vessels, watercraft, engines, machines, or mechanical contrivances which are powered by internal combustion engines or motors.

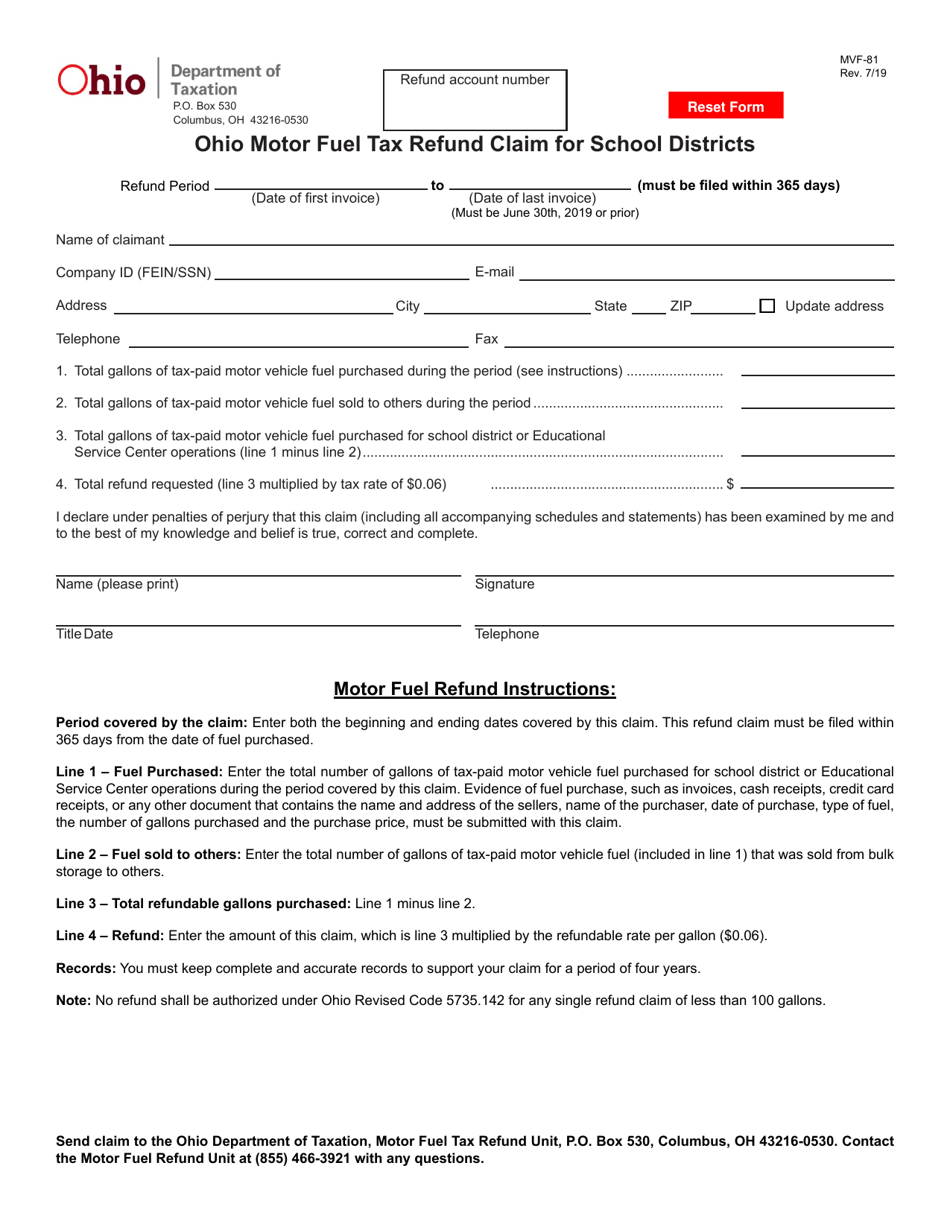

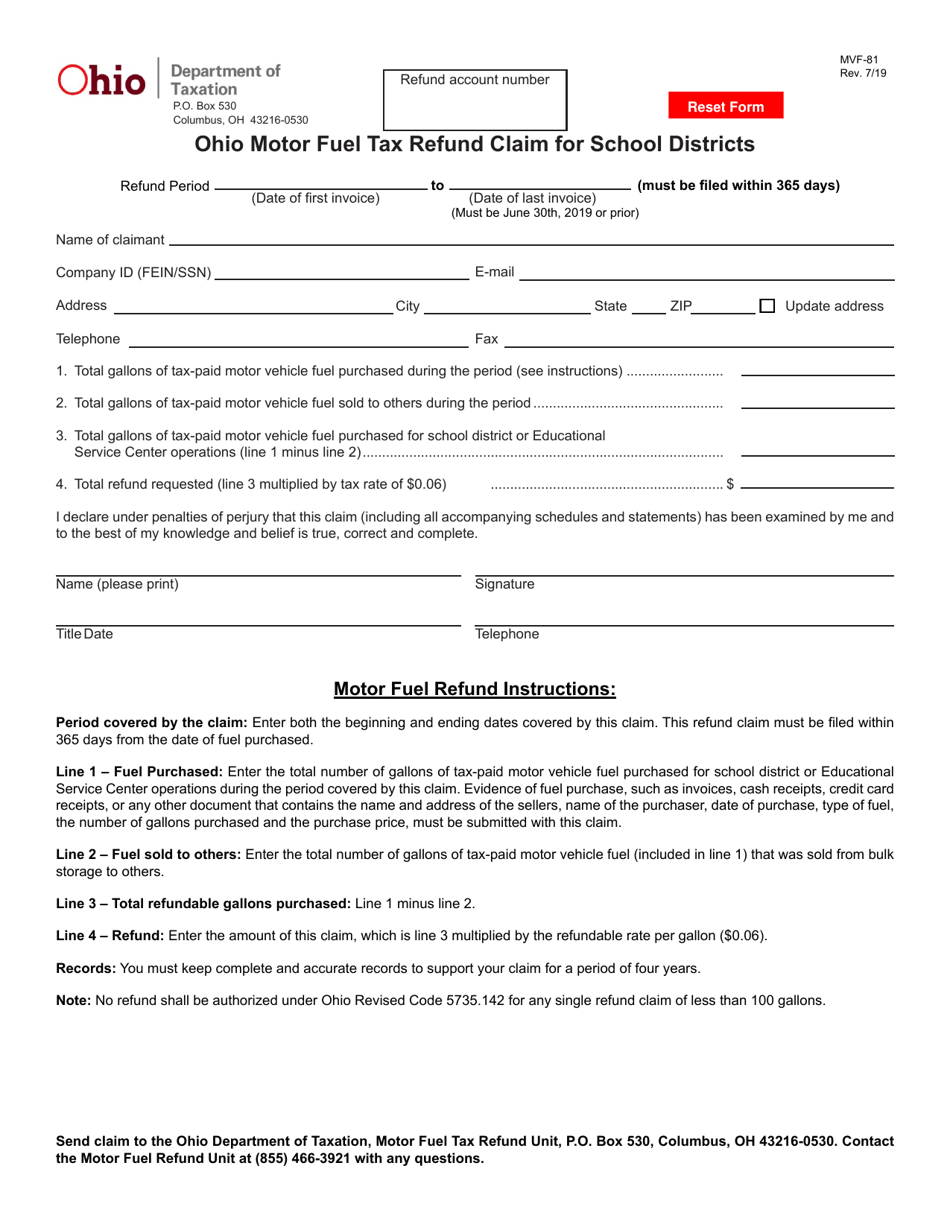

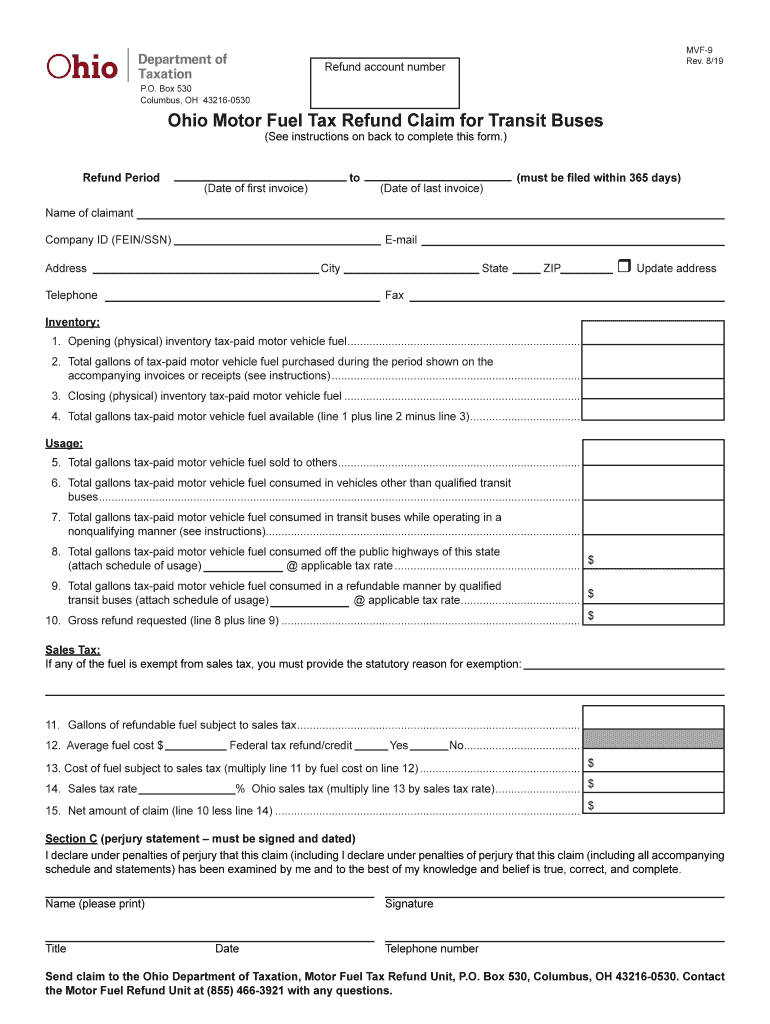

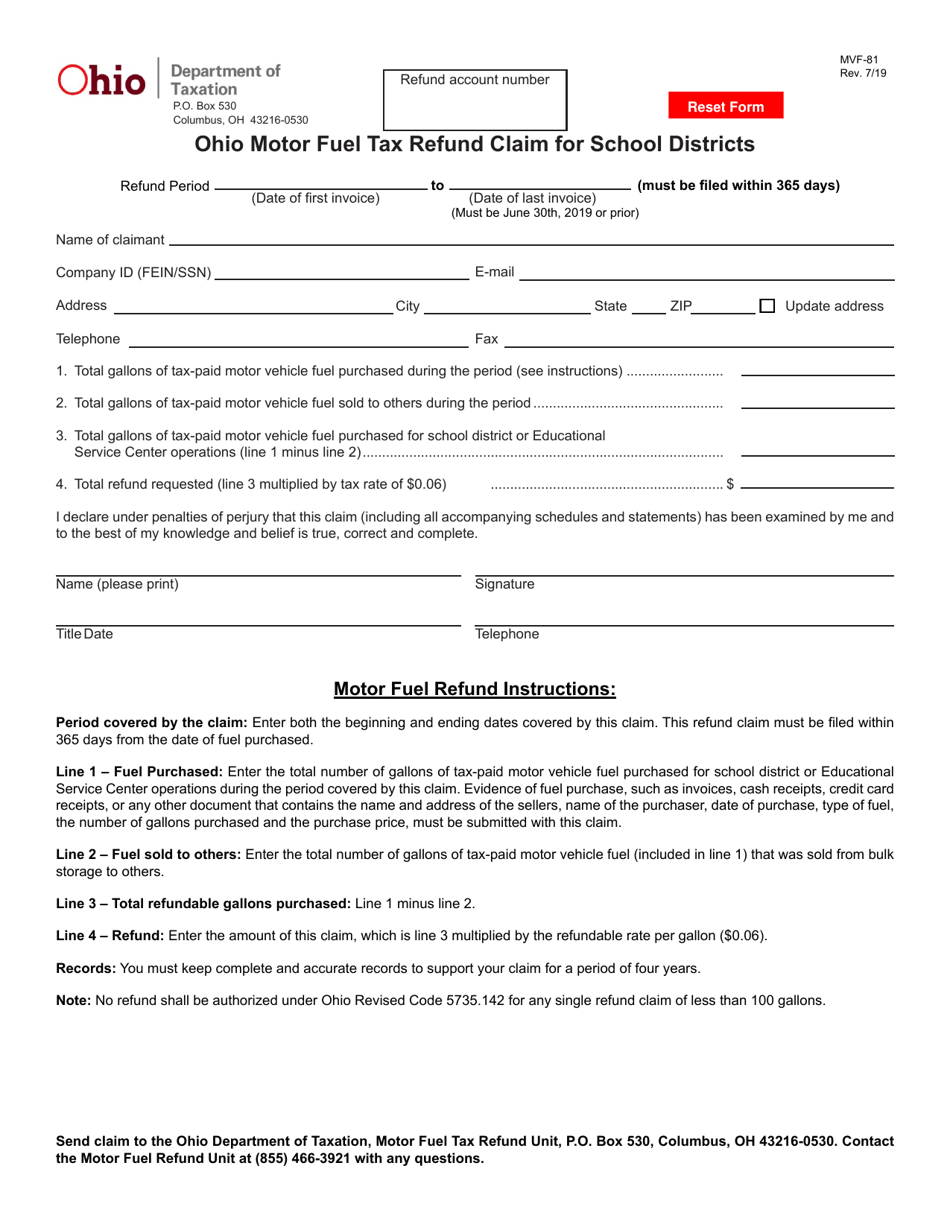

Form MVF81 Download Fillable PDF or Fill Online Ohio from www.templateroller.com

Form MVF81 Download Fillable PDF or Fill Online Ohio from www.templateroller.comGas tax is different for gasoline, diesel, aviation fuel, and jet fuel. The immediate impact on the gas tax rate is neutral. Section 5735.50 notice of federal and state motor fuel tax rates.

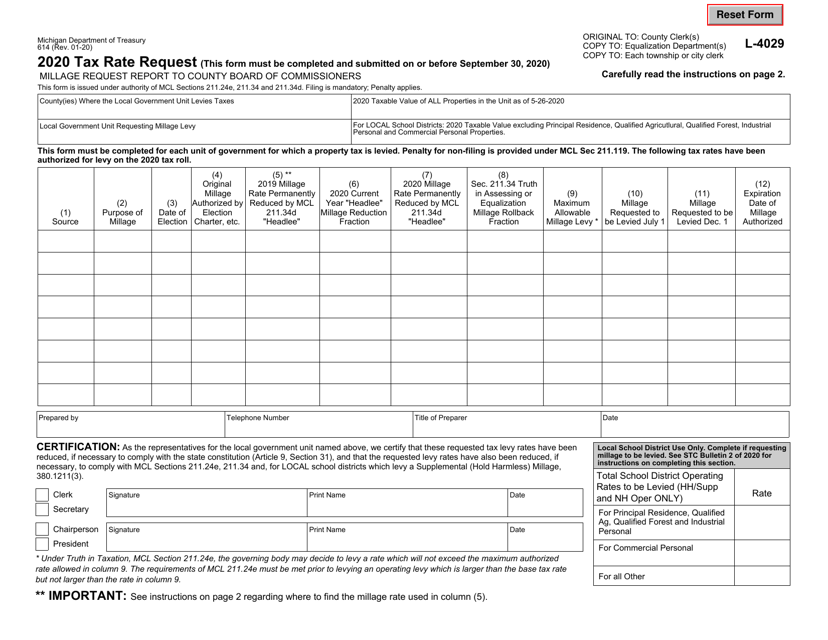

Ohio tax webinar coming may 18th (pdf) 04/28/2016: This quarter 4 jurisdictions have changed their fuel tax rates.

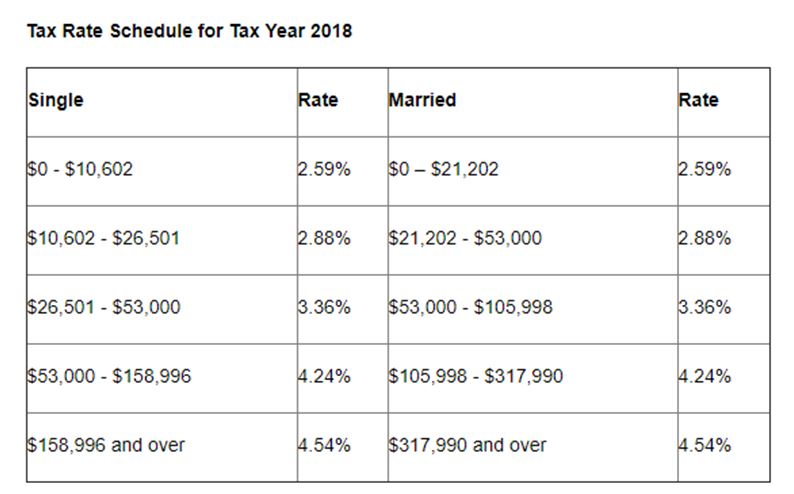

/1 tax rates do not include local option taxes. The state will only accept x12 formatted motor fuel tax returns and reports transmitted via the internet.

The state will only accept x12 formatted motor fuel tax returns and reports transmitted via the internet. $0.13 per gallon until june 30, 2017 $0.16 from july 1, 2017 to june 30, 2018

(4) the fuel excise tax rates in effect on july 1, 2009 were not increased on july 1, 2010. Indiana per capita excise tax.

Variable rate only fuel type variable rate dyed diesel $0.1520 aviation gas $0.1520 aviation jet fuel $0.1520 #1 fuel oil $0.1520 heating oil $0.1520 dyed biodiesel $0.1520 dyed kerosene $0.1520 Oregon fuel tax rates are as follows :

Effective july 1, 2009, the full diesel excise tax rate is imposed on biodiesel fuels that contain less than 90% biodiesel fuel by volume. (b) motor fuel means gasoline, diesel fuel, kerosene, compressed natural gas, or any other.

Jet fuel $0.03 per gallon. Compressed natural gas (cng) $0.184 per gallon †.

If the highway vehicle that uses the motor fuel is owned by or leased to a motor carrier, the operator of the highway vehicle and the motor carrier are jointly and severally liable for the tax. † these tax rates are based on.

This 28 cents per gallon rate is actually Effective july 1, 2009, the full diesel excise tax rate is imposed on biodiesel fuels that contain less than 90% biodiesel fuel by volume.

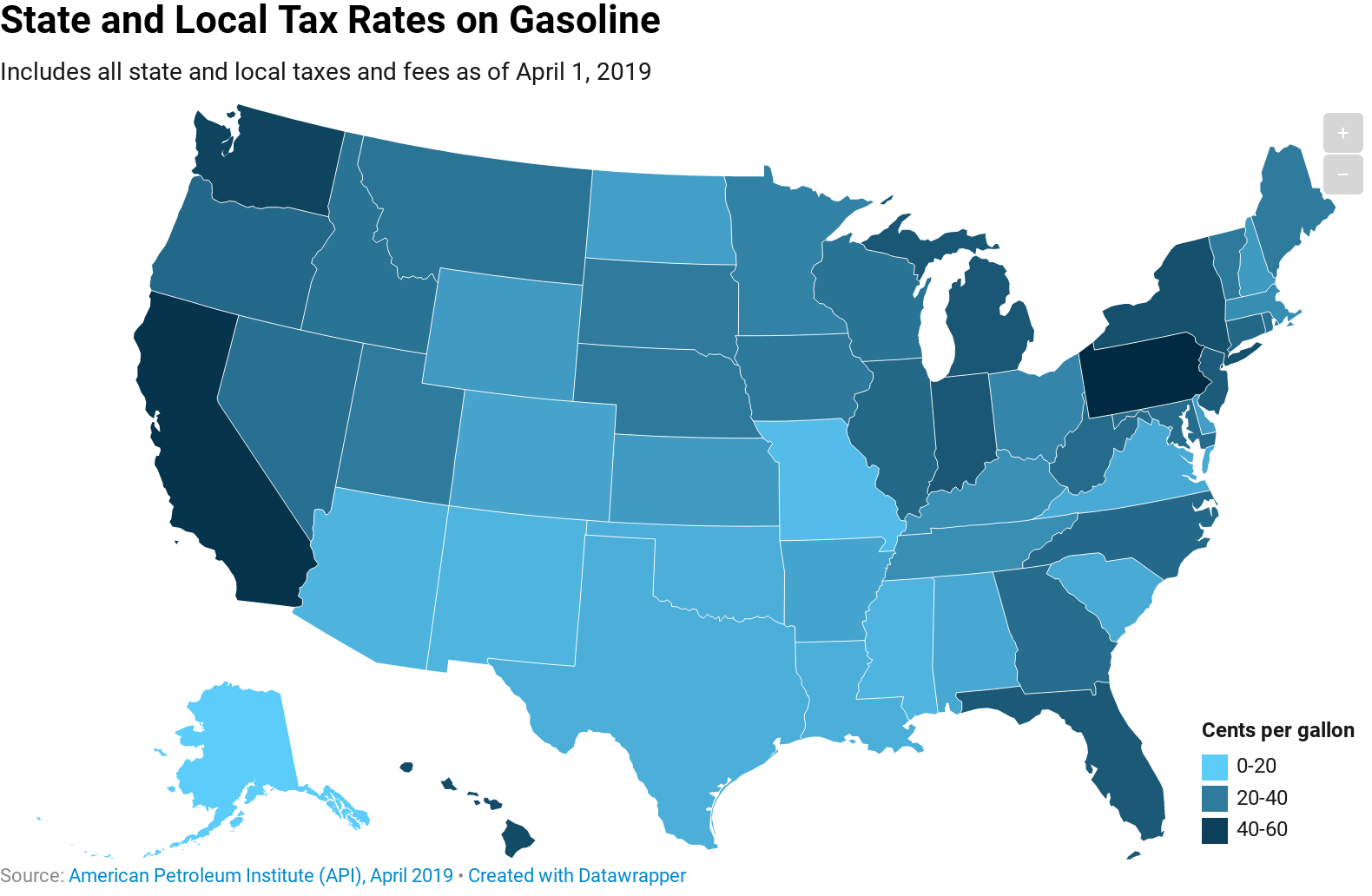

Gas tax is different for gasoline, diesel, aviation fuel, and jet fuel. Effective october 1, 2019, arkansas tax rate for gasoline increased to 24.5 cents per gallon along with ethanol and methanol.

† these tax rates are based on. (b) motor fuel means gasoline, diesel fuel, kerosene, compressed natural gas, or any other.

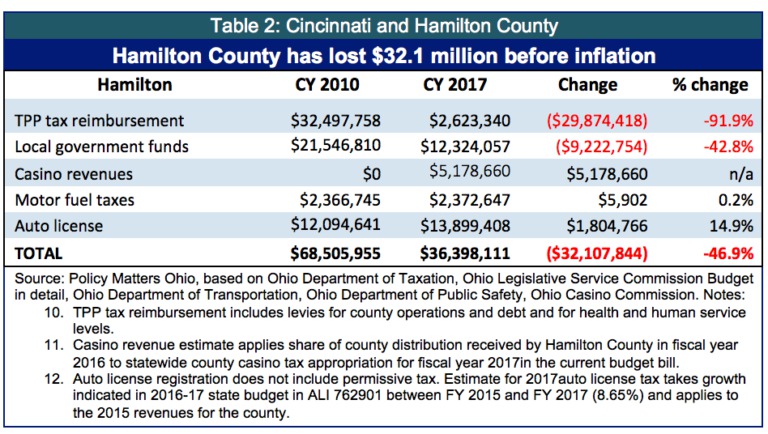

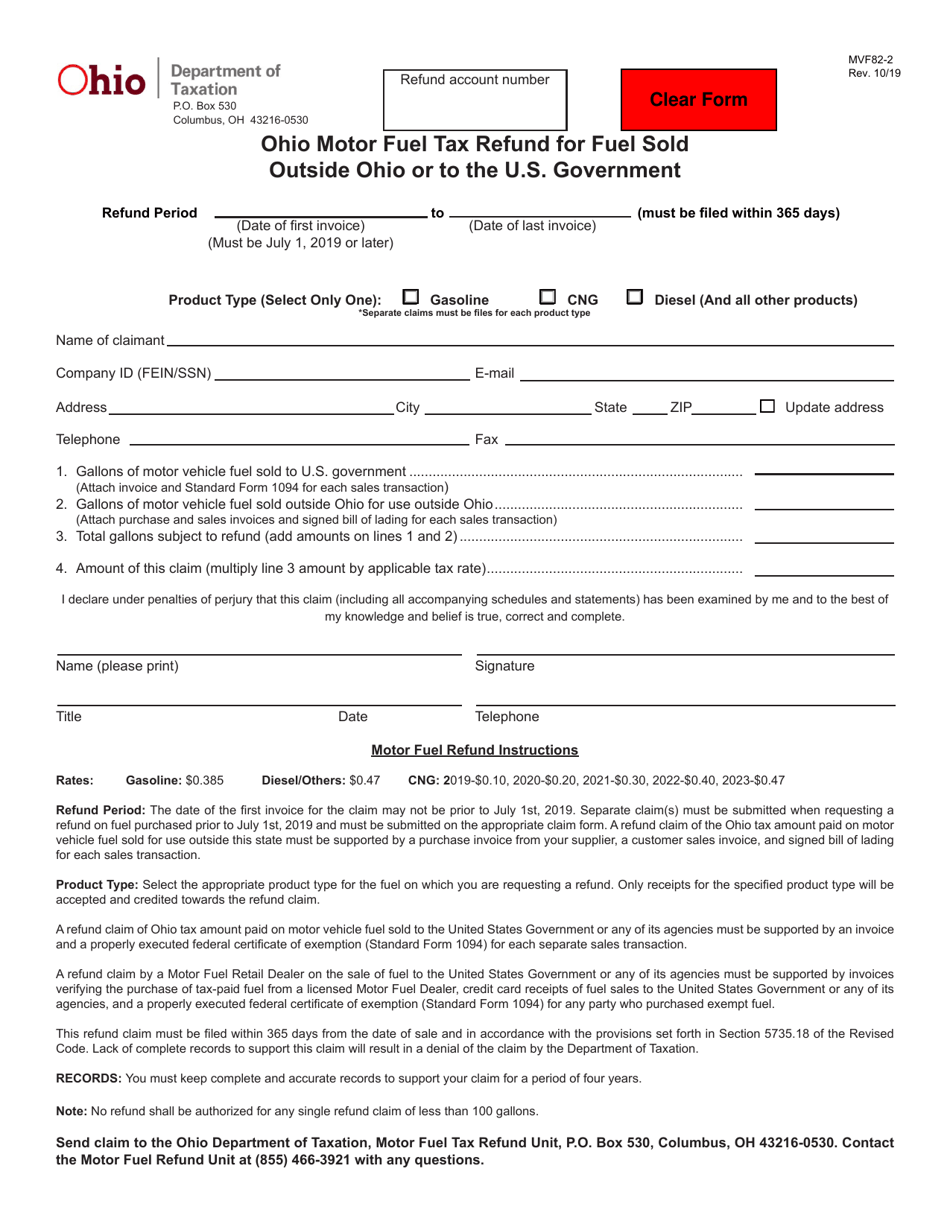

Gross receipts include those amounts received from the sale, transfer, exchange, or other disposition of motor fuel as "motor fuel" is defined in section 5736.01 of the revised code. Ohio tax rates changes effective 7/1/2019.

The diesel tax rate increased to 28.5 cents per gallon along with. Effective july 1, 2019, motor fuel will be taxed at the following specified rates:

Average wholesale prices now available (pdf) 12/09/2016: (5) the law repeals the indexing of motor fuels tax rates on.

The immediate impact on the gas tax rate is neutral. (4) the fuel excise tax rates in effect on july 1, 2009 were not increased on july 1, 2010.

Current gasoline excise tax rate is $.24 per gallon and the current undyed diesel fuel excise tax rate is $.25 per gallon. Gas tax is different for gasoline, diesel, aviation fuel, and jet fuel.

Ohio tax rates changes effective 7/1/2019. (5) the law repeals the indexing of motor fuels tax rates on.

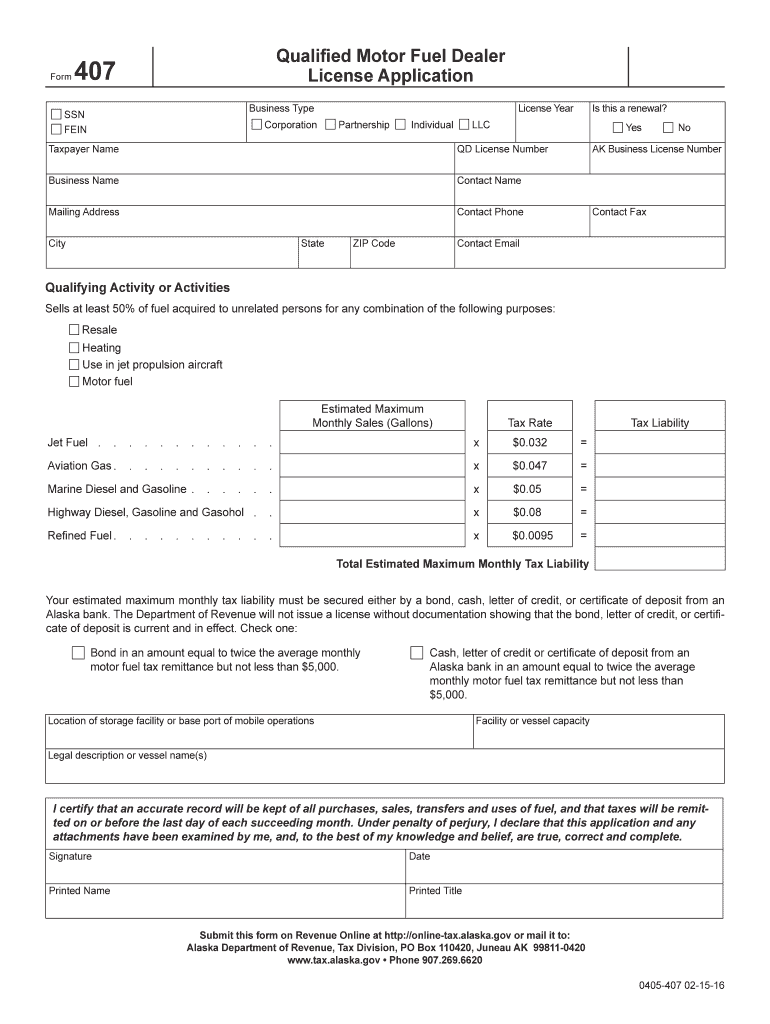

For propane and natural gas dispensed. List of active retail motor fuel dealers;

25th day of the month following the month of activity tax rate: † these tax rates are based on.

The motor fuel tax rate is: The state will only accept x12 formatted motor fuel tax returns and reports transmitted via the internet.

Sd And Tn, One Cent;Average wholesale prices now available (pdf). Compressed natural gas (cng) $0.184 per gallon †. Included in the gasoline, diesel/kerosene, and compressed natural gas rates is a 0.1 ¢ per gallon charge for the leaking underground storage tank trust fund (lust).

N Excise Tax Applies To All Dealers In Motor Vehicle Fuel On The Use, Distribution, Or Sale Within Ohio Of Fuel Used To Generate Power For The Operation Of Motor Vehicles.Indiana collects an average of $433 in yearly excise taxes per capita, lower then 54% of the other 50 states. $0.13 per gallon until june 30, 2017 $0.16 from july 1, 2017 to june 30, 2018 Indiana per capita excise tax.

25Th Day Of The Month Following The Month Of Activity Tax Rate:The diesel tax rate increased to 28.5 cents per gallon along with. Il, 5 cents in chicago and 6 cents in cook county (gasoline only); Use fuel includes premium diesel, biodiesel, and any fuel other than gasoline used to propel a motor vehicle on public roads.

Section 5735.01 | Motor Fuel Tax Definitions.Effective july 1, 2019, motor fuel will be taxed at the following specified rates: Ohio tax rates changes effective 7/1/2019. This 28 cents per gallon rate is actually

Variable Rate Only Fuel Type Variable Rate Dyed Diesel $0.1520 Aviation Gas $0.1520 Aviation Jet Fuel $0.1520 #1 Fuel Oil $0.1520 Heating Oil $0.1520 Dyed Biodiesel $0.1520 Dyed Kerosene $0.1520Effective july 1, 2009, the full diesel excise tax rate is imposed on biodiesel fuels that contain less than 90% biodiesel fuel by volume. Motor vehicle fuel tax a. View the files to download.

Belum ada Komentar untuk "Ohio Motor Fuel Tax Rates"

Posting Komentar